Retail sales in the Chinese sports clothing market reached 316.6 billion RMB (approximately 40 billion euros) in 2019, with a current value growth of 17%. Retail sales of sports shoes in China climbed to 371.8 billion RMB (approximately 47 billion euros) in 2021, accounting for 13.4% of the national apparel market and growing at a faster pace than the overall apparel market in China.

The increasing disposable income of consumers is driving the Chinese sports clothing market to grow at an estimated average annual growth rate of 11% in current value, reaching an estimated amount of 542.5 billion RMB (approximately 68.5 billion euros) by 2024.

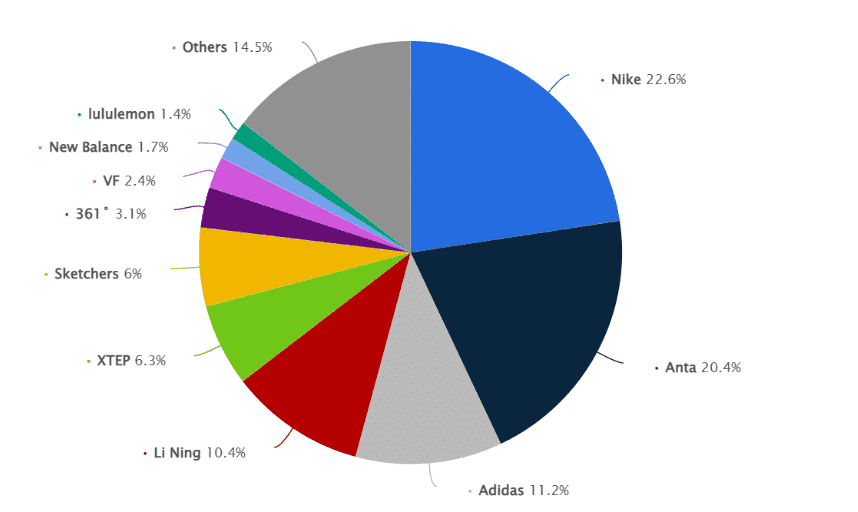

Popular sports clothing brands in the Chinese market International brands dominate the Chinese sports clothing

industry, while Chinese local brands are emerging. In 2022, Nike leads the Chinese sportswear market with a share of 22.6%, while the local brand Anta Sports surpasses Adidas (11.2%) to take the second position with a market share of approximately 20.4%. At the same time, Li Ning’s market share has reached 10.4%.

Who are the consumers? What are their preferences? The Chinese middle class is the driving force behind the sports industry in China. They have more leisure time, are more concerned about their health, and prefer to make healthy lifestyle choices. China has a population of 1.44 billion, with an estimated 400 million middle-class individuals, and this number continues to grow.

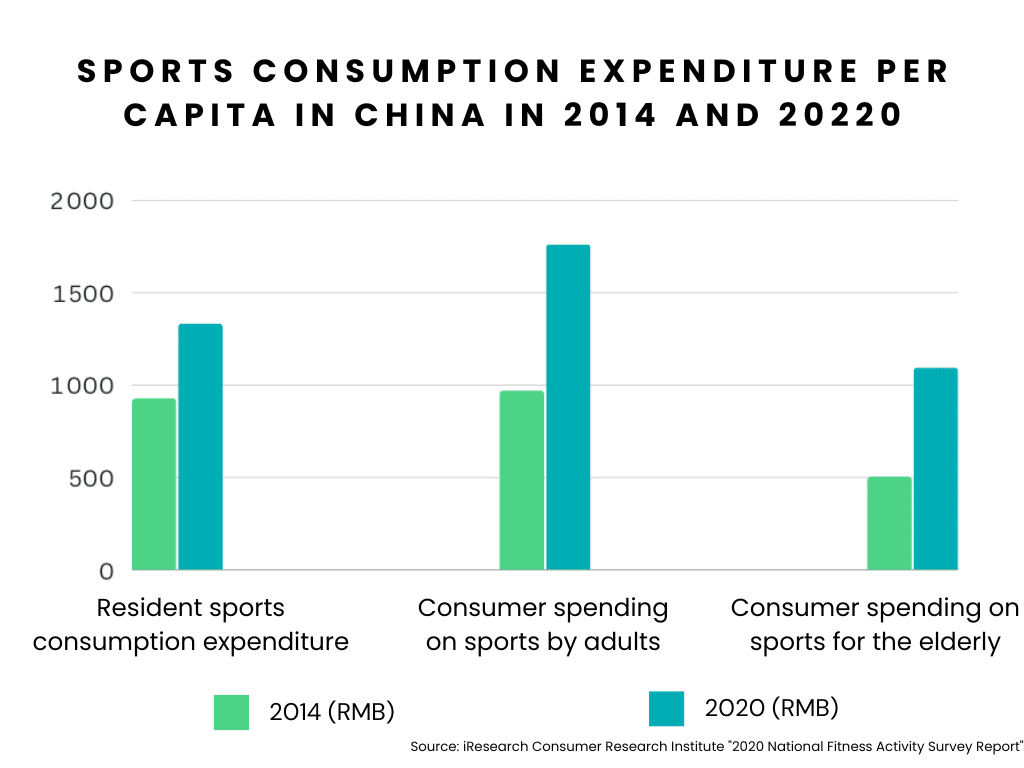

In China, not only is the number of people engaging in physical activities increasing each year, but the per capita spending on sports is also on the rise. In 2020, the penetration rate of physical activity reached around 37% of the population, and enthusiasm for sports is spreading among the youth (aged 15-35). In the same year, per capita spending on sports among adults reached approximately 1,700 yuan.

Women account for 56.2% of active Chinese users on sports and fitness apps, surpassing the proportion of men (43.8%). With the increasing purchasing power of women, brands such as Nike, Feile, Anta, and Tebu have launched numerous digital marketing campaigns targeting them.

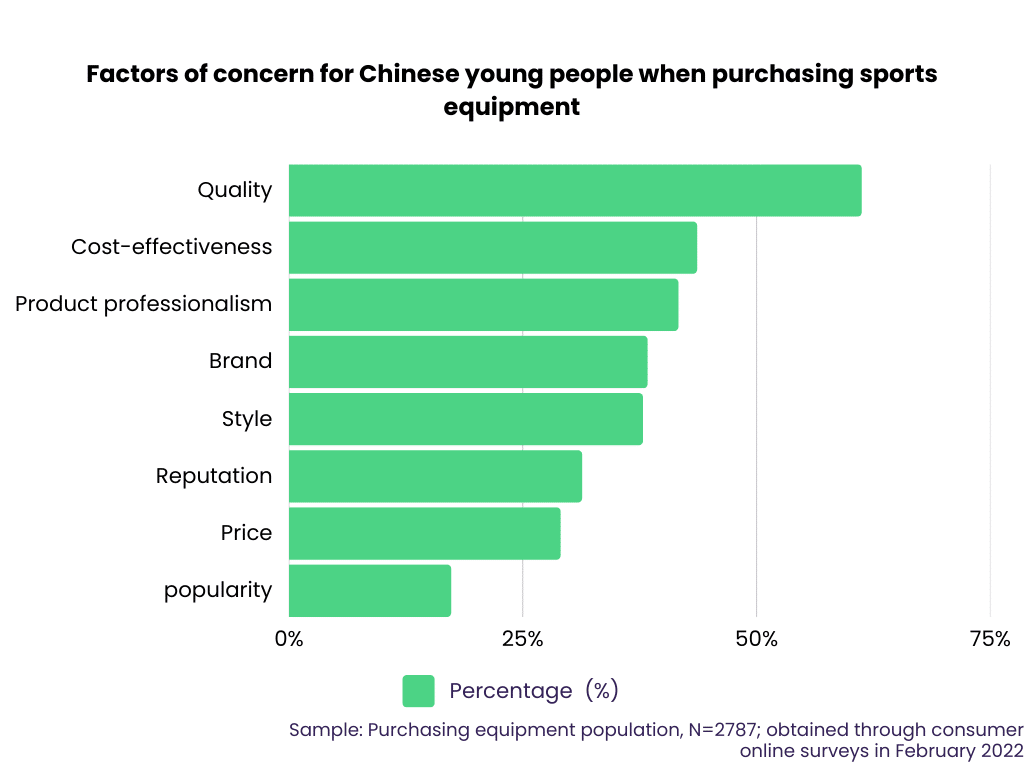

Chinese consumers want sportswear to be both functional and fashionable. According to an online study by Ariadne, Chinese consumers prioritize quality and value for money when purchasing sports equipment, followed by professionalism and brand image. However, the style and design of the products also play a key role in consumers’ decision-making process.

For many young Chinese consumers, exercise is also a social activity. They want sportswear to be both functional and stylish. Additionally, with the rise of fitness, the use of sports shoes has also increased. In addition to being worn in gyms and outdoor sports, many consumers also use sportswear for their everyday outfits. Therefore, they want to feel comfortable and free in their movements while wearing sportswear, while also expressing their personality.

Tips for successfully entering the Chinese sportswear market

To succeed in the Chinese market, international sportswear brands should first identify sub-categories with the greatest sales potential and focus their marketing efforts on these products, striving to create a successful product that will enhance brand awareness and influence.

Technological innovation and design innovation: the keys to entering the Chinese market

Sport shoes, sport t-shirts, and sport pants are highly competitive categories. If you want these products to be popular, it is essential to find distinctive features that set them apart.

Sportswear brands, whether domestic or foreign, are constantly seeking technological innovation. For example, Nike’s HyperAdapt sport shoe model incorporates a self-adjusting lacing system that allows the shoes to adapt to the shape of the foot for personalized fit. Chinese brand Anta, on the other hand, has introduced A-FlashFoam technology in its running shoes, providing powerful cushioning and support for the feet. Columbia, a sportswear brand, has also launched sportswear in China that utilizes Omni-Heat thermal reflection technology.

If your brand also innovates in terms of design, you can use this distinctive feature to position your brand in the Chinese market and carry out targeted marketing actions. By creating flagship products, you can effectively attract early adopters.

Choosing sectors with less competition to penetrate the Chinese market

Indeed, choosing a niche market can be a good strategy for foreign sportswear brands looking to penetrate the Chinese market, rather than competing with well-established brands in the highly competitive sneaker and jogging market. This way, foreign brands can capture the hearts and minds of consumers in areas where competition is lower.

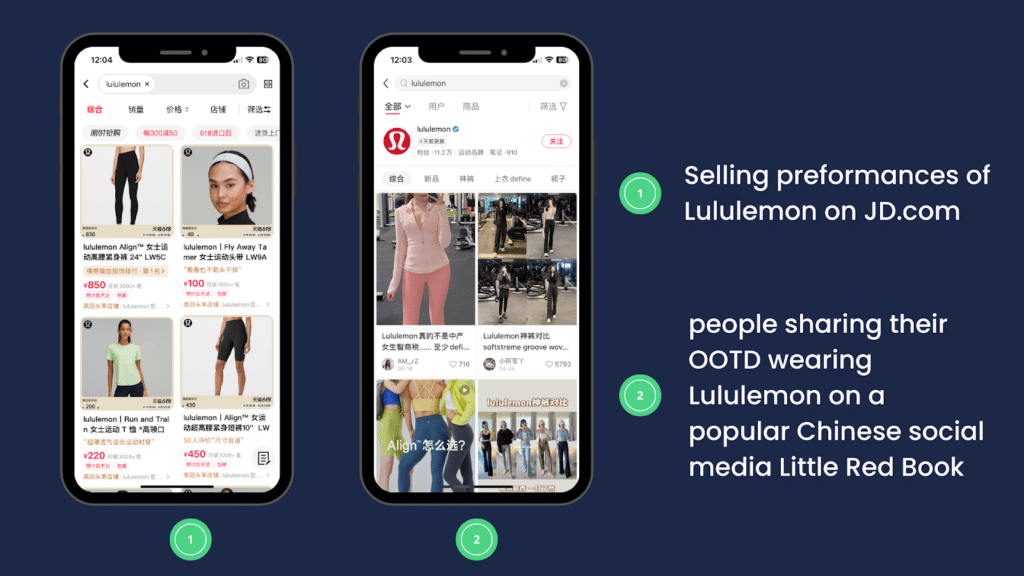

Lululemon is a good example of a sportswear brand that is successful in China through segmentation and targeting of a niche audience. Lululemon’s net revenue in China for 2022 reached $682 million (approximately 4,693 million RMB), representing a 30.1% increase in 2021 and a 128.97% increase in 2020.

In recent years, in addition to yoga, indoor sports, running, frisbee, cycling, and even boxing have become increasingly popular. The popularity of these sports has led to a rapid rise in the popularity of yoga pants, a flattering and comfortable garment. Lululemon is known for its high quality, with each pair of yoga pants selling for nearly 1,000 RMB. Through social media and marketing campaigns shared by users, Lululemon’s yoga pants and clothing have been labeled as “fashion,” which has also alleviated the discomfort of wearing tight-fitting sportswear. By focusing on the yoga clothing segment, Lululemon has successfully attracted middle-class Chinese consumers who are willing and able to pay for yoga clothing.

Sports bras and polo shirts are now promising segments in the Chinese market, as Chinese consumers are placing increasing importance on health and physical exercise. Although these two product categories account for less than 5% of total sales, they show excellent growth rates. Foreign sportswear brands can draw inspiration from Lululemon’s success by carefully selecting their target consumers and positioning themselves in the market, offering innovative designs, high-performance materials, and stylish products based on consumer demand for comfort and functionality. This involves establishing the brand positioning in a market where competition is relatively low.

Digital marketing: An important channel to reach Chinese consumers

If foreign brands want to succeed in the Chinese market, they need to understand Chinese consumer buying habits and target not only their sales channels but also their promotional channels.

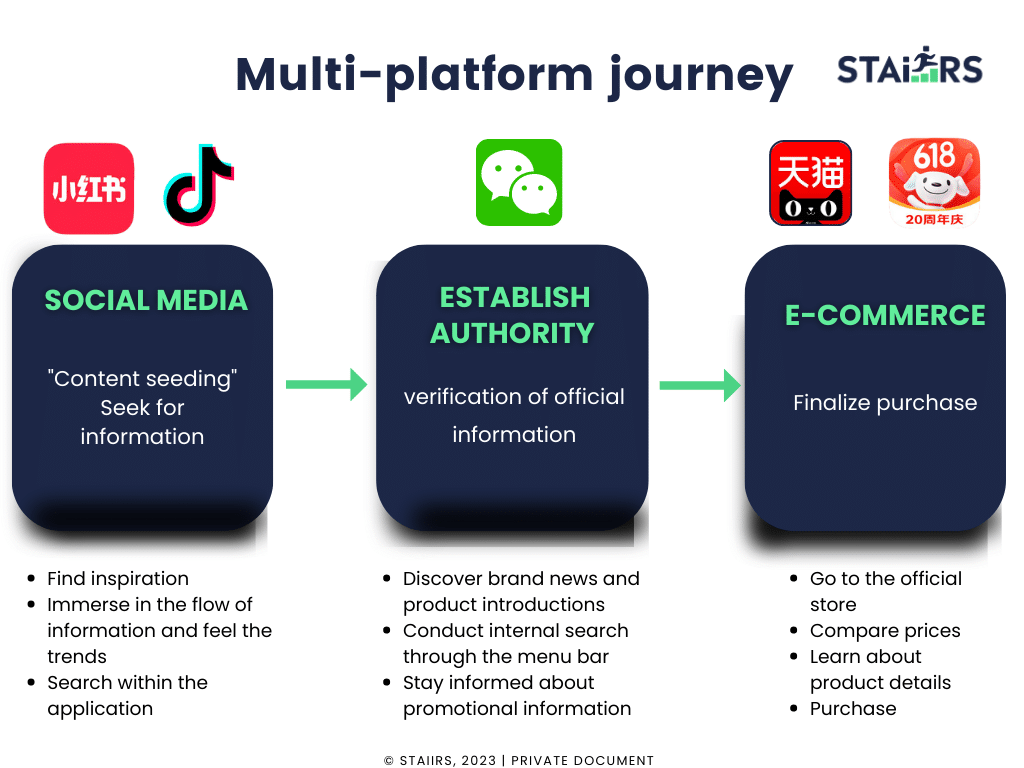

In China, social media platforms are the best way to reach consumers. Social media is not only the first step for brands to reach potential consumers, but also an important channel for consumers to obtain reliable information about the brand. The consumer decision process is as follows:

- Consumers develop initial interest in a brand or product through influencers’ (KOL) sharing on platforms like Douyin and Xiaohongshu.

- Consumers search for reviews on similar products on each platform.

- Consumers follow the brand’s official WeChat account to learn more about the brand’s story or wait for special offers.

- They visit an online shopping platform (such as Jingdong or Tmall) to purchase the product.

By leveraging social media platforms and understanding the consumer journey, international sportswear brands can effectively engage with Chinese consumers and drive sales. It is important to tailor marketing strategies to the Chinese market, utilize key opinion leaders (KOLs), leverage social commerce platforms, and build a strong online presence to connect with and win over Chinese consumers.

Douyin (TikTok)

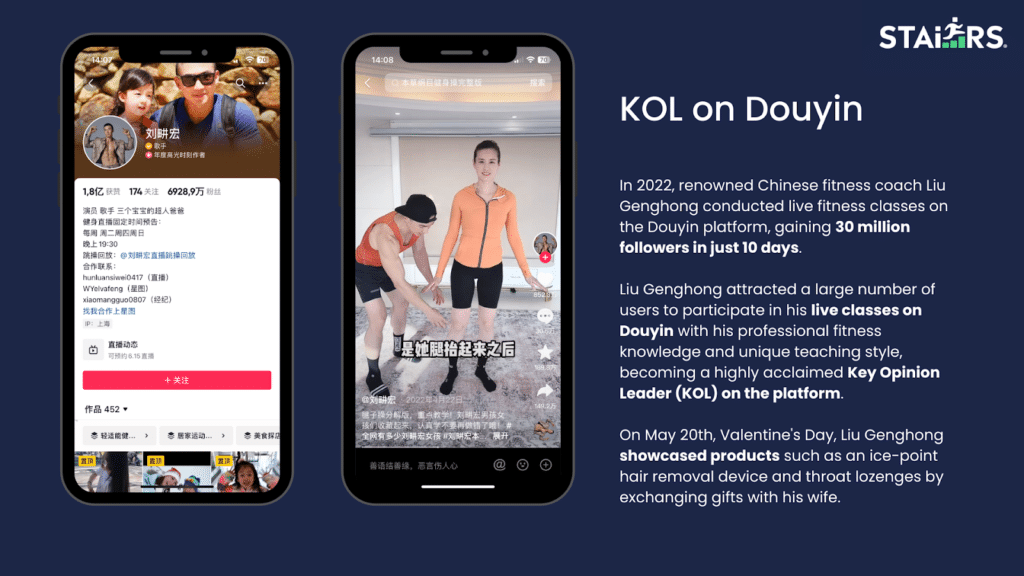

According to QuestMobile, sportswear brands allocate more than half (58.1%) of their advertising budget to advertisements on Douyin (TikTok). The significant user base of Douyin and its highly interactive social environment provide an excellent communication platform for sportswear brands.

“By partnering with Douyin KOLs (Key Opinion Leaders), you can leverage their influence and large number of followers to increase brand exposure and achieve your brand promotion and advertising goals. Invite these influencers to test your sportswear products and share their reviews on their accounts.

Here are some possible strategies:

Product trials and reviews: Collaborate with Douyin KOLs by offering them the opportunity to test your brand’s sportswear items. KOLs can share their experiences and product reviews through videos or live streaming, generating interest and building trust among potential consumers. Brand challenges and themed challenges: Create brand-related challenges or participate in themed challenges in collaboration with Douyin KOLs to encourage users to use the brand’s products for creative expression and sharing. This approach can increase brand visibility and attract more users to engage in interactions. Collaboration on creative content: Work with Douyin influencers to produce creative content such as instructional videos, sports exercise tips, fitness routines, etc. KOLs can demonstrate effective use of the brand’s products, provide professional advice, and showcase sports training, thereby increasing user endorsement of the products. Fan benefits and promotions: Partner with Douyin KOLs to organize special benefits and promotions for fans, such as limited-time discounts, gifts, or exclusive discount codes. With the influence and fan base of KOLs, more users will be attracted to purchase and experience the brand’s products.”

Little Red Book (Xiaohongshu)

Little Red Book, also known as Xiaohongshu, is China’s most popular recommendation and sharing platform, gathering a large number of young users with high purchasing power and a strong desire for sharing. With 16.07 million comments posted on sports-related topics, Little Red Book users actively seek out professional and fashionable sportswear brands.

The recommendations from Key Opinion Consumers (KOC) and Key Opinion Leaders (KOL) are crucial in influencing the purchasing decisions of Little Red Book users. Brands can create official accounts on this platform, regularly publish content to showcase their brand philosophy and product advantages, and collaborate with KOLs to recommend their products. Additionally, Little Red Book also provides a live streaming platform, through which sportswear brands can enhance their interaction with consumers and increase brand awareness.

With 1.313 billion monthly active users in 2022, WeChat is China’s largest social platform. Chinese consumers are accustomed to considering a brand’s WeChat account as the brand’s official website, and they can receive continuous content such as articles or offers from the brand by subscribing to the official WeChat account. Whether it’s establishing brand authority or building a customer relationship management network, creating a WeChat account is the first and most important step in digital marketing for brands in any industry.

Steps to sell sportswear in China:

- Cooperate with distributors (online/offline): For foreign sportswear brands entering the Chinese market and unfamiliar with the market, it makes sense to grant all rights to Chinese distributors. Distributors typically have their own sales channels, and for physical sales (offline), a good distributor utilizing their existing network can quickly distribute the merchandise to the final market, saving the brand time to capture more market share.

- Create your own website: An official website serves as the brand’s portal on the internet. Creating an official website allows for a more detailed presentation of the brand, products, certifications, and quality tests to potential consumers. More importantly, the official website helps strengthen brand recognition and user trust.

The official website is a key page for implementing search engine optimization (SEO) and search engine advertising (SEA) for the sportswear brand. Optimizing the brand’s official website improves its ranking in browser search results, increases visibility, and enhances consumer trust in the brand.

However, if you haven’t registered your business in China, creating an official brand website can be a bit complicated. In China, access to Google is limited, and the search engine Baidu is used instead. If a foreign brand hasn’t registered a business in China, even if you create a website in Chinese, it won’t be indexed by Baidu, which means your potential consumers won’t be able to access your website.

Tmall (e-commerce platform):

Tmall is an online shopping site under the Alibaba Group. Tmall International is Alibaba’s cross-border e-commerce platform, offering directly imported products to Chinese consumers. It provides 100% authentic products and 7-day returns without specific reasons. Chinese consumers have great trust in Tmall.

International sportswear brands have two forms of presence on Tmall International:

- Self-Managed Store: Brands sell their products to Tmall as suppliers, and Tmall is responsible for the sale and service of the products.

- Brand Flagship Store: The brand opens its own official flagship store on Tmall and pays fees to have control over the creation, management, and operation of the online store.

JD.com (online shopping platform)

Jingdong International is a branch of the Jingdong Group, primarily engaged in cross-border importation. It has gained a great reputation among Chinese consumers for its efficient logistics and customer service.

Jingdong International has attracted nearly 20,000 brands with nearly 10 million SKUs (Stock Keeping Units) under management. Its product categories are diverse and include fashion, nutrition, cosmetics, health products, and imported foods. Jingdong International works with international brands from over 70 countries, including the United States, South Korea, Japan, Australia, France, and Germany.

Self-Managed Store: Products in the store managed by Jingdong are purchased, transported, and sold by the Jingdong platform itself. These products will have the label “autogéré” (self-managed) on their product pages. They are typically shipped by Jingdong, which also handles the after-sales service. Brands can benefit from Jingdong’s logistics and after-sales service in self-managed stores.

Brand Flagship Store: The brand or exclusive licensee of Jingdong can create an official store on the Jingdong platform. Jingdong charges annual fees, except for merchant management and customer service (refunds, complaints, etc.), and Jingdong does not participate in the operation of the stores.

In summary, for sportswear, an excellent marketing strategy can yield significantly better results with less effort. With the increasing demand, various local and imported brands are competing to attract Chinese consumers. All brands are considering ways to build their reputation in the Chinese market.

As Chinese consumers are becoming more health-conscious, the sports, fitness, nutrition, and wellness sectors hold great potential. For foreign sportswear brands looking to enter the Chinese market, now is the time to capture Chinese consumers through brand innovation and designs. With precise market positioning and an effective digital marketing strategy, you have the opportunity to establish a presence in this rapidly growing sector.

If you want to learn more about the sportswear market in China and explore effective marketing approaches, feel free to contact us now. STAiiRS’ international team of professionals will provide you with detailed insights!

Recent Comments