Powdered Milk Market Volume in China

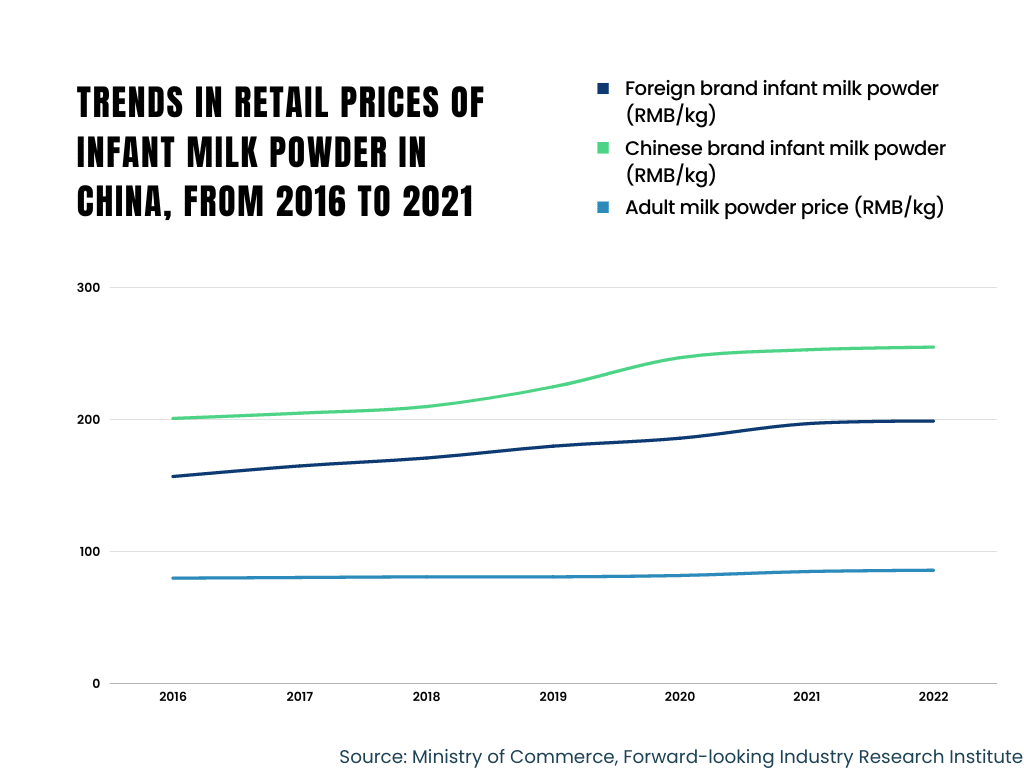

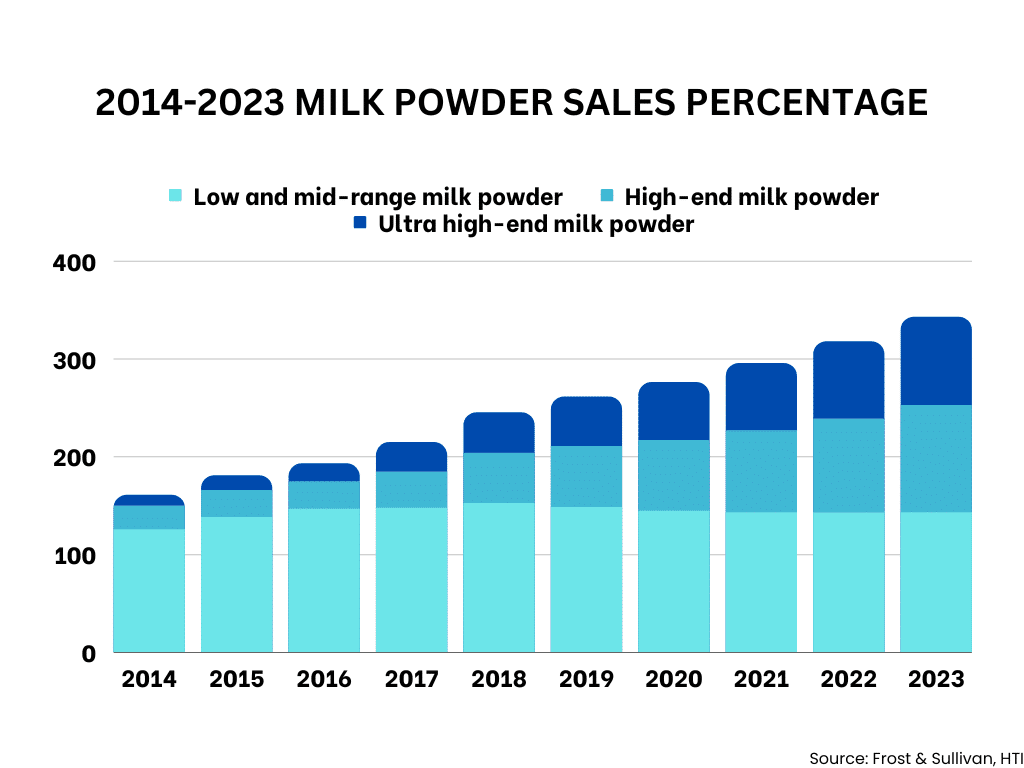

Despite the declining birth rate in China combined with the economic impact of the pandemic, the powdered milk market continues to grow overall. The Chinese powdered milk market is transitioning from volume-based growth to price-driven growth, and Chinese consumers are receptive to high-quality powdered milk. In 2022, the size of the Chinese infant milk market reached 171.663 billion yuan, with a CAGR (Compound Annual Growth Rate) of 2.91% between 2017 and 2022.

This represents a great opportunity for foreign high-quality powdered milk brands. We offer you a detailed guide to enter the Chinese market.

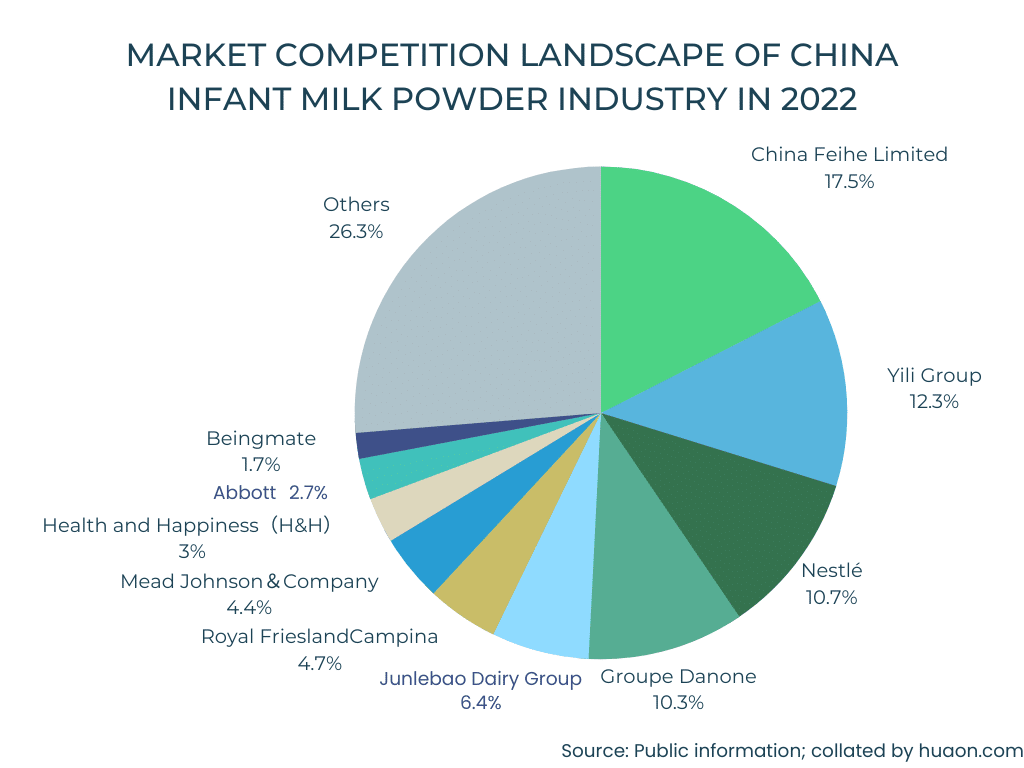

Key Players in the Chinese Infant Milk Market

From a competitive standpoint, following the 2008 Chinese milk contamination scandal that resulted in the deaths of several children, foreign brands quickly seized the Chinese market, increasing their market share to 60% by 2015. To avoid adulterated milk, Chinese consumers now rely on imports.

According to statistics, the top 5 brands in terms of revenue in 2022 are Feihe, Yili, Nestlé, Danone, and Junlebao. Among the top 10 brands, 6 are imported powdered milk brands, ranked in order of revenue:

- Nestlé

- Danone

- FrieslandCampina

- Mead Johnson

- Abbott

Powdered Milk Consumers in China

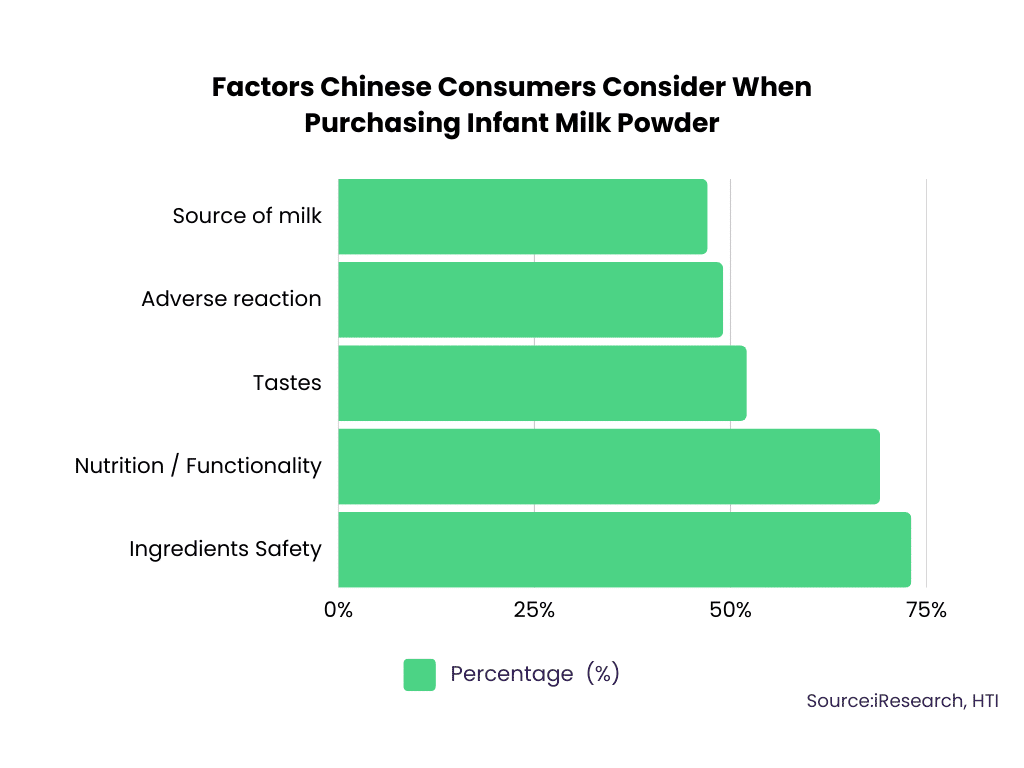

According to iResearch data, in 2021, consumers of maternity and infant products are mainly aged between 26 and 30, accounting for 49% of the population. Therefore, individuals born after 1990 are the primary consumers in this market. This segment of the population is willing to try new products and brands while placing greater importance on product functionality, safety, and value for money.

Regarding new products, 57% of respondents born after 1990 are concerned about the nutritional value and effects of the product, while 54% are concerned about the ingredients and the product’s value for money.

Thriving Chinese powdered milk market Chinese consumers value high-quality powdered milk. The new generation of baby and maternity product consumers (born in the 90s and 95s) place greater importance on the quality, formula, ingredients, and functionality of powdered milk. According to iResearch, over 90% of consumers pay attention to the high quality of powdered milk.

Powdered Milk Products Analysis in China

In general, premium powdered milks (priced above 390 yuan/kg) are experiencing the fastest growth. High-end powdered milks (290-390 yuan/kg) are the most intensely competitive segment between domestic and foreign brands, with a concentration of domestic high-end brands in this price range. As for mid-to-low range powdered milks (priced below 290 yuan/kg), they have the largest market share but are experiencing a downward trend, with the presence of many small and diverse brands in this price range.

The evolution of the powdered milk market across different types In terms of classification by stages of powdered milk, the category of growing-up milks (12 to 36 months) holds the largest market share, while specialty milks have the smallest market share. In terms of growth trends, milks with special formulas have the fastest growth rate, followed by growing-up milks (12 to 36 months). On the other hand, first-stage milks (0 to 6 months) and second-stage milks (6 to 12 months) are experiencing negative growth.

Goat milk powder and organic milk powder: A new trend in China Compared to traditional powdered milk formulas, goat milk and organic milk, which require high standards in terms of origin, ingredients, and production, have experienced rapid growth in the past two years.

From January to October 2022, Chinese online sales platforms recorded a significant increase in the sales of goat milk and organic milk.

The cumulative sales volume of goat milk amounts to approximately 3.6 million units, with revenues exceeding 900 million yuan, representing a growth of 25% compared to 2021. As for organic milk, its sales reached around 4.1 million units, with revenues surpassing 1.2 billion yuan, a growth of 20% compared to the previous year.

Brand Reputation : the Key to Win Chinese Consumers

Chinese consumers are not price-sensitive when it comes to powdered milk. Their search for high-end and organic formulas provides a favorable environment for foreign brands. As long as you successfully carry out your digital marketing and establish a strong presence and good reputation in the Chinese market, you have great chances of succeeding in this opportunity-filled market.

Succeeding in the Chinese powdered milk market through digital marketing Whether it is for online sales or physical stores in baby shops, brand reputation is extremely important. Chinese consumers attach great importance to the opinions of other consumers (Key Opinion Consumers – KOC) or influencers (Key Opinion Leaders – KOL). They will not purchase products from brands they have never heard of or products that have received numerous negative reviews.

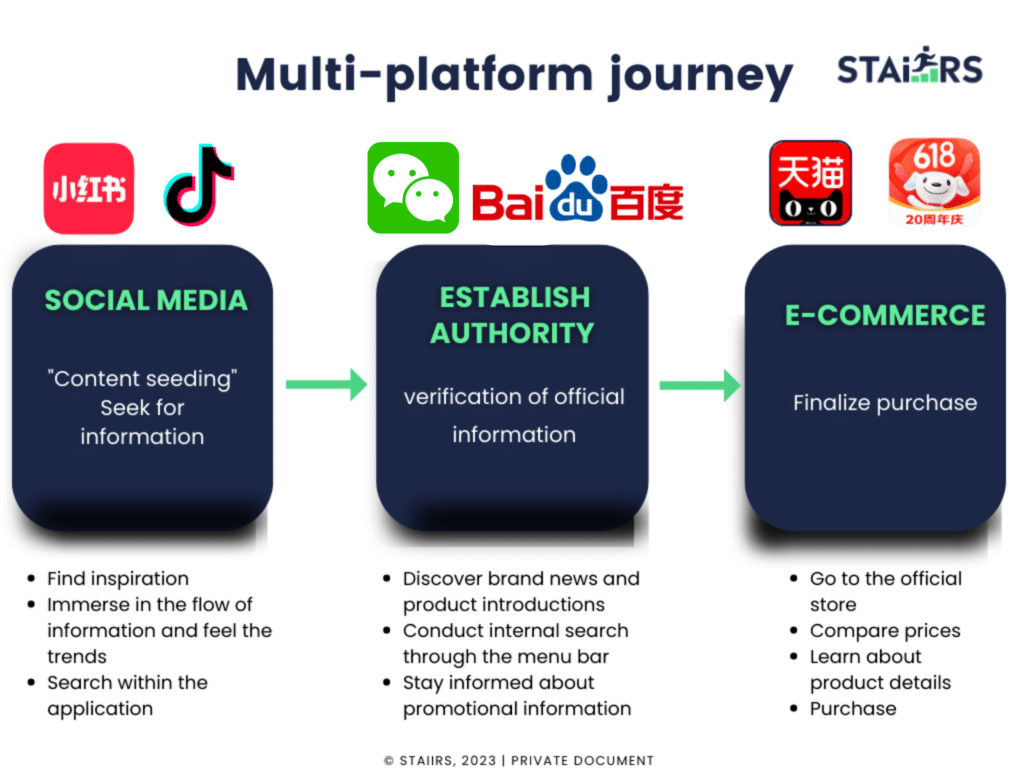

The typical Chinese consumer behavior is as follows:

STEP 1: Seek for information

Search for the keyword “powdered milk” on social media and discover your product. Search your brand name on Baidu to verify if it is an official brand. Search for your brand as a keyword on social networks to read other consumers’ comments. Purchase the product.

Little Red Book (Xiaohongshu)

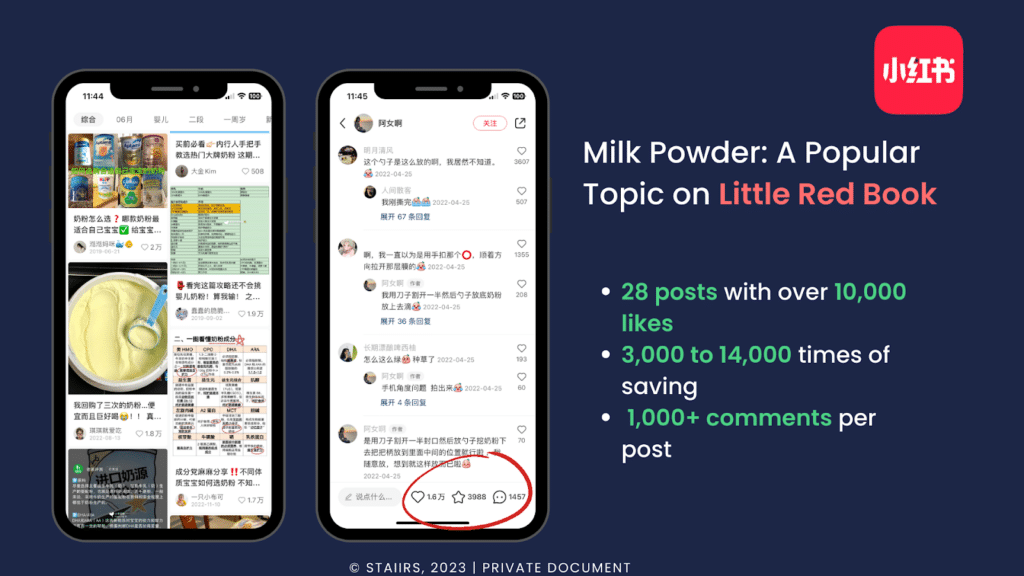

Cooperating with KOLs to increase brand awareness Little Red Book (or Xiaohongshu) is one of the most important platforms for sharing shopping experiences and conducting product reviews. As of January 2023, Little Red Book has 250 million users, the majority of whom are young people, particularly women. These users lead sophisticated lifestyles, show keen interest in new brands and products, and have significant purchasing power. Therefore, they closely align with powdered milk buyers.

Creating an official and certified account on Little Red Book is the first step to establish your brand’s credibility, but most importantly, you should work with influencers (KOLs) on this platform. You can reach out to KOLs to write reviews or send them samples, asking them to try the products and share their experiences. These initiatives can be effective in increasing brand awareness.

Using Little Red Book for digital marketing with KOLs offers the following advantages:

Precise targeting of potential consumers: Little Red Book has a powerful algorithm that can accurately push promotions or reviews containing your products to users who have browsed the baby products category, which can result in better conversion rates. High engagement rates and strong interaction: Consumers heavily rely on comments and opinions from others and share them on Little Red Book after positive or disappointing experiences with a product. In general, the number of comments on a popular article can reach 1,000 or more. Low cost: You can choose to collaborate with KOLs based on their level of influence. Working with KOLs or KOCs (Key Opinion Consumers) who have a limited number of followers but a highly targeted audience will not require a high budget, yet you can achieve excellent results.

Douyin (TikTok)

In China, Douyin holds significant influence. Foreign powdered milk brands looking to enter the Chinese market can fully leverage this high-traffic platform to increase their brand awareness. On one hand, you can create your brand account on Douyin and request official certification, then regularly post videos. On the other hand, you can actively collaborate with influencers (KOLs) to create reviews or recommendations of powdered milk in the form of short videos.

STEP 2: Confirming brand credibility through communication channels

Official brand website

The official website serves as the brand’s portal on the internet. Creating an official website allows for a more detailed presentation of the brand, its products, certifications, and quality tests to potential consumers. More importantly, the official website helps strengthen brand recognition and user trust.

The official website is a key page for implementing search engine optimization (SEO) and search engine advertising (SEA) for the powdered milk brand. Optimizing the brand’s official website improves its ranking in search engine results, increases visibility, and enhances consumer trust in the brand.

However, if your company is not registered in China, creating an official brand website can become a bit challenging. In China, access to Google is limited, and the search engine Baidu is used instead. If a foreign brand has not registered a business entity in China, even if you create a website in Chinese, it will not be indexed by Baidu, meaning that potential consumers will not be able to access your website.

Baidu Baijia

Therefore, for foreign brands looking to enter the Chinese market but unable to create an official website on Baidu, creating an official Baidu Baijia account is an important step in increasing brand awareness and credibility.

Baidu Baijia is an official platform launched by the Baidu browser. Baidu’s algorithm has a preference for articles published on Baidu Baijia, which means that foreign powdered milk brands with an official and certified account on Baidu Baijia enjoy greater visibility.

By using this certified Baidu Baijia platform, foreign brands can effectively enhance consumer understanding of the brand and strengthen consumer trust.

WeChat is the largest social media platform in China, with over one billion users. It is not just a communication platform but also an important channel for obtaining information. For Chinese consumers, an official brand account on WeChat is a symbol of credibility.

Compared to Baidu Baijia account, the official WeChat account is more similar to a brand website, offering features such as product launches, brand PR, promotional offers, customer support, and interaction with consumers. By following an official brand account, consumers can directly receive brand information, which is crucial for increasing user loyalty.

How do Chinese consumers purchase powdered milk?

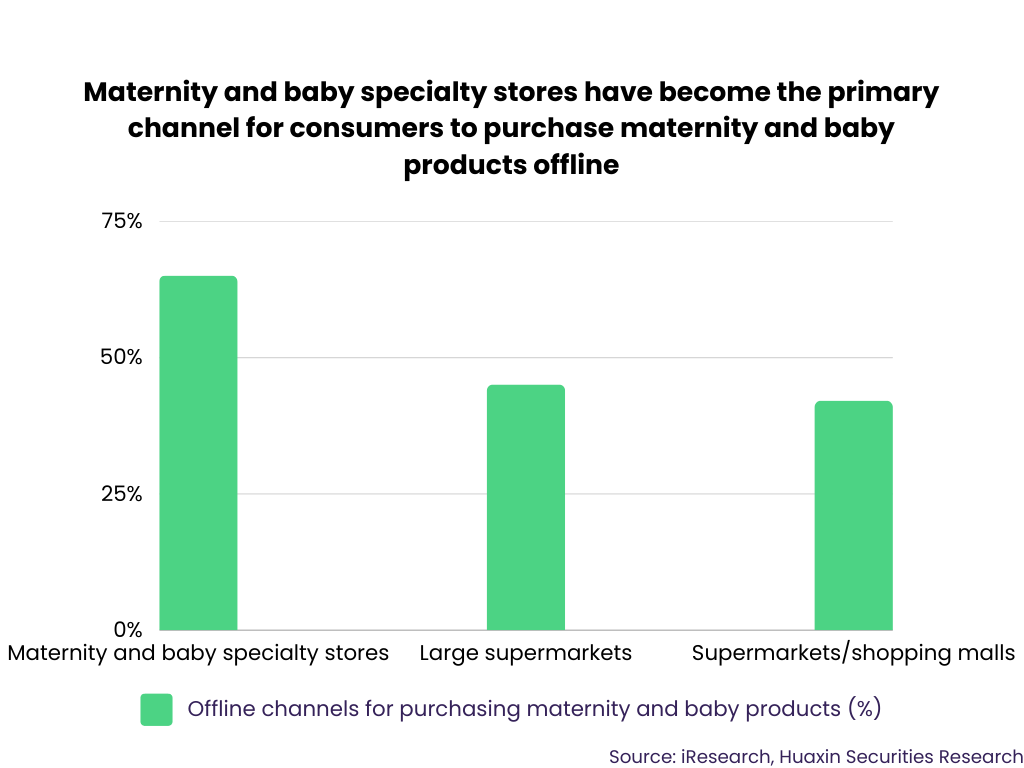

Offline Milk Product Distribution Channels

Specialty stores for baby products are the primary sales channels for powdered milk in lower-tier cities. Sales of high-priced powdered milk have experienced significant growth in these cities.

The “2022 Maternal and Infant Industry Insight Report” shows that between June 2021 and June 2022, sales of premium powdered milk witnessed strong growth in specialty stores in lower-tier cities. Sales of high-end milk (average price of 390 to 520 yuan/kg) and ultra-premium milk (average price ≥ 520 yuan/kg) increased by 29.4% and 24.3%, respectively.

For foreign powdered milk brands looking to enter the Chinese market but are not yet familiar with offline sales channels, collaborating with baby store chains or distributors is a good option.

According to a survey conducted by iResearch in 2021, 55% of consumers of baby products in lower-tier cities tend to seek advice from salespeople in specialty stores. Therefore, leveraging the existing customer base of baby stores or distributors is an excellent way to strengthen the brand’s reputation. It can also save time by quickly distributing your products to the end market, allowing your brand to gain more market share.

Online Milk Product Distribution Channels

In China, there are various cross-border e-commerce platforms such as Tmall International, JD Global, VIP.com, Ymatou.com, Kaola.com, etc. These cross-border e-commerce platforms offer international powdered milk brands more convenient administrative procedures, allowing them to sell products without having a registered physical presence.

According to data from Ai Media Consulting, online sales channels for powdered milk are mainly dominated by general e-commerce platforms. 71% of consumers choose to purchase baby products through general e-commerce platforms, 35% opt for platforms specializing in baby products, and 19% choose social e-commerce platforms. Ai Media Consulting predicts that the share of online sales for baby products will increase from 22.6% in 2016 to 39% in 2025.

Tmall

Tmall Global, Alibaba’s import platform, is the most trusted platform for Chinese consumers to buy imported products. So far, over 29,000 foreign brands from 87 different countries and regions have entered Tmall International. These brands cover more than 5,800 categories, with over 80% entering China for the first time.

There are two types of entry on Tmall International:

Tmall Flagship Store: Brands sell their products to Tmall as suppliers, and Tmall is responsible for the sale and related services, including product delivery.

Tmall Official Store: The brand opens its own store on Tmall and pays fees to have control over the store’s creation, management, and operation.

JD International

Jingdong International is a brand under the JD Group, which focuses on cross-border trade of imported products and has gained a great reputation among Chinese consumers for its efficient logistics. With nearly 20,000 brands and 10 million SKUs, Jingdong International’s product categories include fashion, nutrition, health and beauty products, and imported food. Jingdong International collaborates with international brands from over 70 countries, including the United States, South Korea, Japan, Australia, France, and Germany.

Self-managed stores on JD.com

Products from self-managed stores are purchased, shipped, and sold by JD.com, the platform itself. These products are labeled as “self-managed” on their product pages. Brands can take advantage of JD.com’s logistics and after-sales service for self-managed stores.

Brand Flagship Stores on JD.com

Jingdong’s own brands or holders of exclusive licenses can open flagship stores on the platform. JD.com charges annual fees and does not participate in the operation of the store, except for merchant management and customer service (refunds, claims, etc.).

STAiiRS helps you conquer Chinese consumers

STAiiRS is a French company specialized in digital marketing services, with proven experience in the Chinese market. We can provide you with a complete range of services for digital marketing and the creation of online stores in the Chinese market:

- Creation of certified official accounts for your powdered milk brand on various platforms.

- Video publication, content creation, and article layout.

- Search engine optimization and data optimization on social media to improve your brand’s visibility through keyword optimization.

- Collaboration with Key Opinion Leaders (KOLs) that align with your brand positioning.

- Assistance in opening online stores on major cross-border e-commerce platforms in China (such as JD.com and Tmall). We will provide you with comprehensive support, from store design to order management.

Do you want to learn more about the powdered milk market in China and explore effective marketing strategies?

Feel free to contact us now. STAiiRS’ international team of professionals will provide you with detailed answers!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.