The Potential of China’s Alcohol Market

Among professionals in China’s alcohol industry, there is a widespread saying: “China has never lacked alcohol, but it has long lacked good alcohol.”

Since 2020, the Chinese market still has immense potential for alcohol consumption growth. Many foreign alcohol companies have adopted proactive strategies to enter China, ranging from agency, and distribution, to even establishing factories in China.

In Chengdu, China, there is an exhibition that serves as an opportunity-rich platform for all Chinese and international alcohol factories entering the Chinese market. This exhibition can be considered the El Dorado for China’s alcohol industry professionals. It’s a pivotal point that cannot be bypassed by alcohol enterprises of all sizes seeking growth.

Click to know more about selling wine in China👉 : How to sell wine in China?

An Expansion Project in China? We Can Help You!

The China Food and Drinks Fair

Known as the “barometer” of China’s food industry, one of China’s longest-running large-scale professional exhibitions.

In 2024, the spring edition of the Chengdu Food and Drinks Fair had an exhibition area exceeding 300,000 square meters, with nearly 6,600 exhibiting companies and over 300,000 visitors.

The average transaction volume at each spring fair reaches 20 billion RMB, with alcohol transactions alone exceeding 10 billion RMB. This is why the fair has long been regarded as a “major transaction platform” by China’s alcohol merchants.

At the fair, Australian companies took a different approach compared to their European counterparts. While Australian companies focused on building influence and brand image, European companies achieved effective production and sales docking. This resulted in them establishing deep-rooted cooperation relationships.

Through close contact with consumers or local manufacturers, foreign companies can obtain a wealth of information about China’s national industry laws and regulations, as well as forward-looking information about China’s alcohol industry. All of these are key to foreign companies establishing a solid development path in China.

Chinese Consumer Psyche: An Unsatiable Curiosity

According to Statista, China stands as the world’s largest spirits market and is poised to become the global leader in wine consumption, making it a key strategic market for numerous wine, spirits, and beer brands.

Despite industry uncertainties regarding the scale and nature of imported alcohol in China. A survey of high-income consumers in major Chinese cities reveals that China’s economic situation has not exerted a significant impact on the premiumization trend within the alcoholic beverage industry.

High-income Chinese consumers are exhibiting a shifting preference in their consumption of foreign spirits, particularly among the middle class. Their consumption patterns showcase a pursuit of premium and novel experiences, with foreign spirits becoming an integral part of their social gatherings.

This implies that foreign spirits products are increasingly perceived as collectibles, social lubricants, and objects of connoisseurship among high-income Chinese consumers.

Click to know more details👉: How Do Brands Strategize Online and Offline Sales Channels?

However, this fascination with high-end and novelty does not imply that foreign spirits companies can simply rely on “newness” to achieve smooth sailing in China.

Post-COVID-19, the imported alcohol industry in China has witnessed a shift towards greater specialization and professionalism. Surviving importers have implemented more effective corporate structures and strategic planning. They also coupled with stricter wine selection criteria from the very source. Chinese wine producers have responded to the growing emphasis on “domestic” products among younger consumers by enhancing their quality standards.

Therefore, it is evident that a diverse range of flavors, unheard-of ingredients, innovative packaging designs, and “niche” origins can all serve as entry points into the Chinese spirits market. However, unwavering quality remains the cornerstone of China’s alcohol industry.

The receptiveness and eagerness to experiment exhibited by Chinese alcohol consumers in the high-end spirits market have spurred many distilleries to continuously iterate and develop new products. The future holds promise for an increasingly vibrant market landscape.

Keys to Long-term Success in China’s Market

In the current competitive landscape of China’s alcohol industry, many merchants suffer from positioning confusion and blindly launch new products to seize market opportunities.

This leads some wineries and trading companies to disregard branding and cater excessively to consumer preferences.

To differentiate from such phenomena, foreign alcohol brands are generally more easily accepted by mid-to-high-end consumer groups in China.

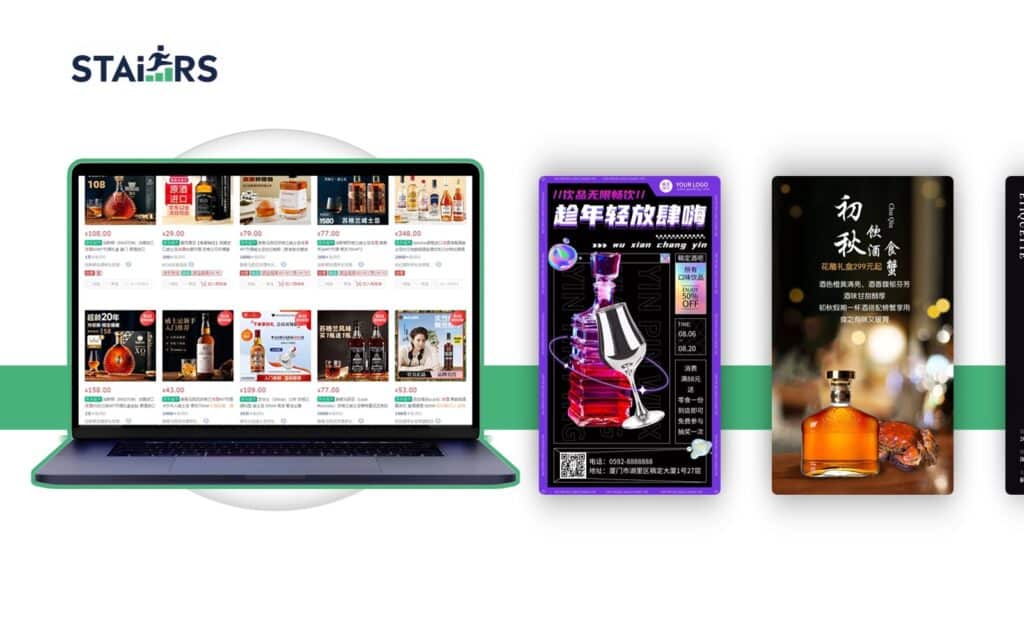

Therefore, the performance on e-commerce platforms directly affects foreign alcohol merchants’ sales in China as 55% of Chinese alcohol consumers choose to order online. This is also why Chinese alcohol merchants have more diverse and active digital marketing efforts.

For example, iMoutai, China’s most influential baijiu brand, launched a digital baijiu trading platform app. Through the app’s integrated access to 12 e-commerce platforms, consumers can order and reserve new products anytime.

Preparing for the Food and Drinks Fair

The Chinese alcohol market is an extremely promising one. Although sales channels remain traditional, the digitalization process has been put on the agenda by the entire industry.

When overseas wineries want to use the Food and Drinks Fair as a foothold to pry open the door to the Chinese market, they need to consider the following five suggestions:

Social Media Platforms

Utilize China’s major social media platforms such as WeChat, Weibo, and Douyin to engage with potential customers. Create engaging content that resonates with Chinese consumers, such as interactive posts, live streams, and influencer collaborations.

Utilize E-commerce Platforms

Platforms like Tmall and JD.com are where Chinese consumers most often purchase alcohol online.

In China, food safety is a top priority when choosing food and beverage products. So when buying higher-priced alcohol products, people prefer platforms with official product sources or reputable merchants closely cooperating with foreign companies.

Develop a Localized Digital Presence

Tailor your website and digital content to suit the Chinese market by translating into Mandarin and adapting digital marketing strategies to align with local cultural nuances. Ensure your website is accessible in China, considering the Great Firewall restrictions.

Engage with Online Wine Communities and Platforms

Connect with online communities of wine lovers and professionals through digital platforms (such as Wine World, iHongjiu, and Jiuxian). Participate in online trade shows, webinars, and virtual tastings to educate potential customers about your brand and products, building a loyal customer base.

Implement Targeted Advertising and SEO

Use targeted digital advertising and SEO strategies to increase visibility on Chinese search engines like Baidu and Sogou. Tailor keywords and content to match Chinese consumers’ search behaviors for higher search rankings and easier product discovery.

Conclusion

The immense potential of China’s alcohol consumption market is evident to all. This is why many overseas manufacturers have invested resources to compete in the Chinese market and achieved remarkable results.

After years of accumulation and consumer recognition, brand and quality have gradually become the main competitive advantages for alcohol merchants in the Chinese market.

Today, only by fully respecting China’s market mechanisms and adopting localized marketing strategies can one successfully break through and establish a solid brand barrier in the Chinese market.

The Food and Drinks Fair provides an opportunity-rich entry point for many companies. By preparing digital marketing activities in advance for the fair and connecting online and offline, international alcohol merchants can gain more opportunities to develop their business in the Chinese market.

Recent Comments